.jpg)

In the first quarter of the year, the UK real estate investment market demonstrated resilience and active participation. Despite ongoing uncertainties, such as geopolitical shifts and regulatory changes, investor sentiment remained positive. This was fuelled by strong demand for residential and alternative assets. Government initiatives promoting affordability, infrastructure, and sustainability underscore a favourable outlook.

With regards to the lending landscape, there is liquidity in the market, however, lenders are doing their due diligence and there is a strong emphasis on Gross Development Values (GDVs) and exit strategies to ensure Loan to Values (LTVs) are at an appropriate risk profile.

At Karis Capital, as specialist debt advisors, we work with a wide range of property investors and developers nationwide, undertaking investments of varying sizes across a multitude of asset classes. Over the next couple of years, we anticipate a continued move toward property investors seeking operational companies backed by real estate rather than a focus on just acquiring the property. A model that is certainly gaining prominence amongst our client base.

We’ve observed many larger SME/regional housebuilders and portfolio investors diversify into alternative markets, with an op-co led vision, to mitigate their risk. This trend encompasses various asset classes, such as care homes, purpose-built student accommodation (PBSA), social housing, and build-to-rent properties, due to each benefitting from a strong supply and demand chain.

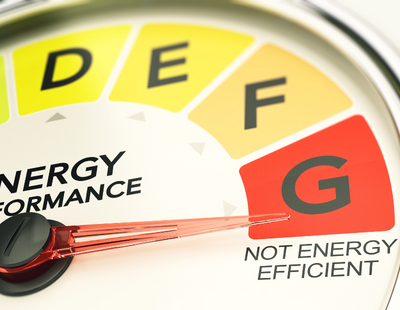

Less appealing to investors

According to Knight Frank investment in UK Build to Rent (BTR) reached £4.6 billion in 2023, a record high. The leading property firm also predicts a surge in the value of the UK PBSA sector, projecting growth from £85.8bn in 2023 to £104bn by 2028.

So, what is the reason for this shift? A contributing factor is the UK residential market conditions, where yields are not sufficiently strong enough to offset the high cost of financing. Consequently, traditional straightforward investments are becoming less appealing to investors.

Amidst these market dynamics, one reoccurring question we encounter from our clients seeking finance is ‘Should I opt for a fixed rate or wait for potential rate decreases as I don’t want to overpay on my facility.’ In the past 15 years this question has never been so important.

The factors property investors may want to consider;

- How many base rate reductions do we need before a variable rate truly becomes a cost-effective alternative?

- Given prevailing Yield constraints, particularly in the southeast, does the debt service coverage stack up on variable rates?

- To what extent must a borrower comprehend hedging options to be able to navigate them effectively?

- What are the potential implications to the portfolio’s performance in the short, medium and long term?

Navigating the choice between fixed and variable rates demands a deep understanding of market dynamics, individual financial circumstances, and risk management strategies. This is where a specialist debt advisor is crucial for assessing hedging options and conducting comprehensive financial analysis to ensure affordability and to mitigate risks, especially in regions with yield constraints.

Thoroughly explored

In the long term, proactive monitoring and adaptive financial planning are essential for optimising portfolio performance. Continuous assessment is required and adjustment of strategies to align with evolving market conditions and investment objectives.

Considering these complexities, it has never been a more crucial time to conduct a thorough analysis of a property portfolio and establish a model to optimise its performance over the next five years. As numerous borrowers approach the end of their low five-year fixed-rate terms in the months ahead, now is the time to act and partner with an experienced advisory firm to ensure all avenues have been thoroughly explored.

Karis Capital’s service offerings have seen their real estate finance team work alongside leading prime property developers and across a number of high-profile projects in recent years. Karis’s unrivalled hands-on experience helps guide their clients to the best rates and lenders in the markets while also pursing maximum returns, building extensive relationships with finance leaders, valuers and lawyers to ensure smooth transactions from start to finish.

.jpg)

.jpeg)

.jpg)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment